News update

Get up to speed with the latest developments from the wider world of pensions.

The Government’s Budget announcement on 30 October 2024 announced that it is proposing to legislate that most ‘unused’ pension funds, and some death benefits, will be included in estates for inheritance tax (IHT) purposes.

Following a consultation a summary of measures was announced on 21 July 2025, providing greater clarity in respect of the forthcoming legislation. The headlines as they affect Savings Trust members are:

- Death in service benefits for current employees will be exempt from IHT

- Death in deferment benefits are likely to be exempt if they are made to a spouse or civil partner, however they may be in scope for IHT if payments are made to any other beneficiaries

Draft legislation is not expected until later in 2025. But the payment of lump sums from pension schemes will become more complicated – impacting the administration of estates and ultimately leading to delays in paying beneficiaries.

Background

Since Pension Freedoms were launched in 2015, more and more people have turned away from traditional annuities and moved towards using drawdown for their retirement. With drawdown, retirement savings remain invested, and anything left over at death doesn’t form part of the estate when assessing for IHT.

Naturally, this led to defined contribution schemes becoming an attractive option for passing on wealth to beneficiaries without it being assessed for IHT.

The Government says it wants to make sure that pension savings are used for retirement and not used as a way to pass on wealth tax free. It has been consulting with the pensions industry on how its proposal could be implemented.

Here are the things you can do right now to help your family and beneficiaries avoid additional stress after your death:

Make sure you’ve nominated your beneficiaries

If you have three or fewer, do it now on Aviva’s MyWorkplace. If you want to nominate more than three people, you can download Aviva’s Beneficiary form. Just complete it and return it to the address on the form.

Make a list of your benefits and assets

Your personal representative will have to gather this information after your death in order to administer your estate. You can make it much easier by making sure they have access to a copy of your list. Be sure to include:

(i) The type of benefit or asset (e.g. a pension, shares, property etc)

(ii) Its value

(iii) Contact details so your personal representative knows who to speak to about the benefit or asset.

Make a will

Research from the Money and Pensions Service (MaPS) shows that 56% of UK adults haven’t made a will, including 53% aged between 50 and 64 years of age.

A will lets you decide what happens to your money, property and possessions after your death, which makes administering your estate a lot easier for your personal representative.

Unlike other financial services, the will writing market is not regulated. It’s a good idea to check if a solicitor will be reviewing your will, or if the will writing service is regulated by the Solicitors’ Regulation Authority (SRA).

There’s a lot more detail to come on this topic, and some things could change when the legislation is published. We’ll keep you updated in next year’s newsletter.

Retirement Living Standards

Pension UK’s Retirement Living Standards are here to help you understand what income you might need every year in retirement. They’ve been calculated following extensive research into how today’s retirees are living their lives.

The Standards show what income you might need for a ‘minimum’, ‘moderate’ or ‘comfortable’ retirement. Bear in mind they’re telling you what you might need ‘after tax’, and they assume that you aren’t going to be paying off a mortgage, or paying rent, in retirement.

Remember that most people will qualify for the State Pension, which is a useful building block of your retirement income. The full rate is currently £11,973 a year.

The latest figures show a reduction in the amount needed to meet the minimum standard – driven by a reduction in energy costs and spending adjustments made by retirees. For moderate and comfortable standards, the figures have increased in line with inflation.

Retirement Living Standards for a single person

Retirement Living Standards for a couple

Retirement Living Standards

Get the full details at the Retirement Living Standards website.

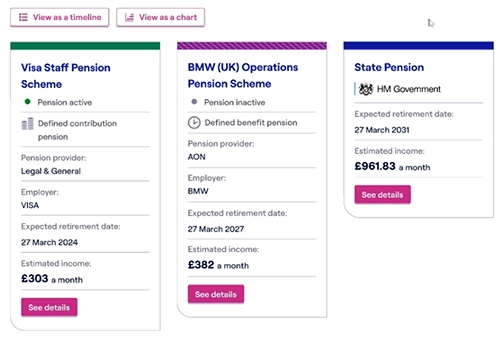

Coming soon – Pensions Dashboards

Pensions Dashboards will allow you to see an overview of all your UK pension memberships in one place – handy if you’ve been in quite a few different schemes.

We’re pleased to report that the Savings Trust successfully connected to the Dashboard platform in June 2025. This means that we’re ready to send information about your Savings Trust membership directly to your Dashboard account whenever you request it.

If you’re worried about your personal information being stored on another database, don’t be. Your data will only travel from the Savings Trust to your Dashboard account when you sign up for an account and ask to connect with us. It won’t be held on a separate system.

For the latest news, visit www.pensionsdashboardsprogramme.org.uk

An example of how the Dashboard might look