CHAIR’S WELCOME

Welcome to the Trustee’s 2021 annual newsletter for members of the Rolls-Royce Retirement Savings Trust. We hope this year’s newsletter helps your understanding of how the Trust works, as well as keeping you informed of the latest developments.

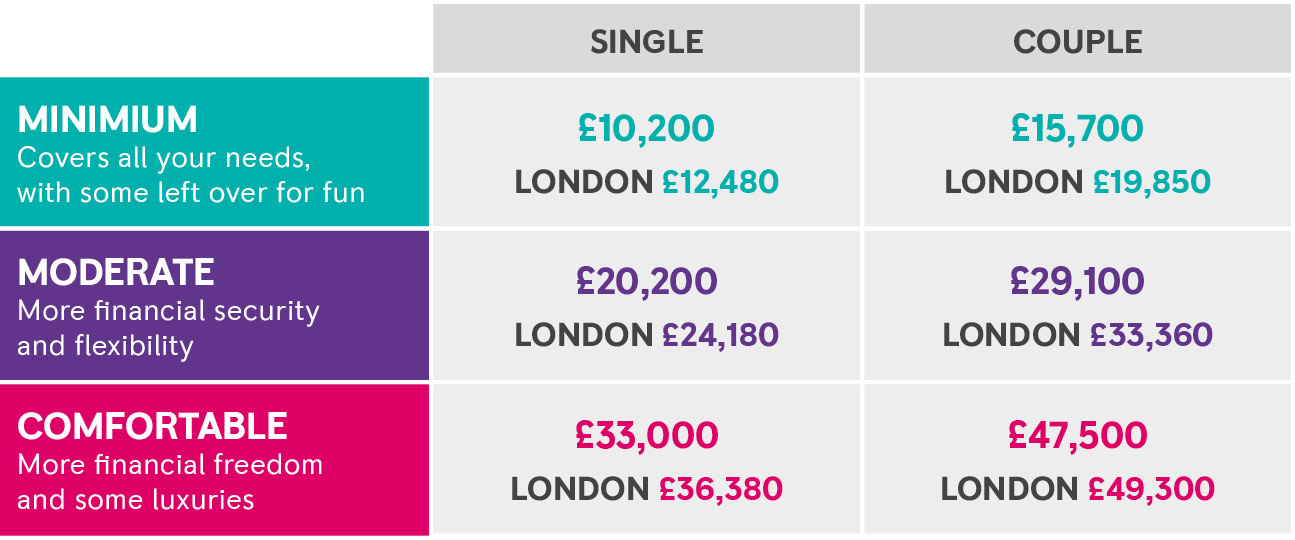

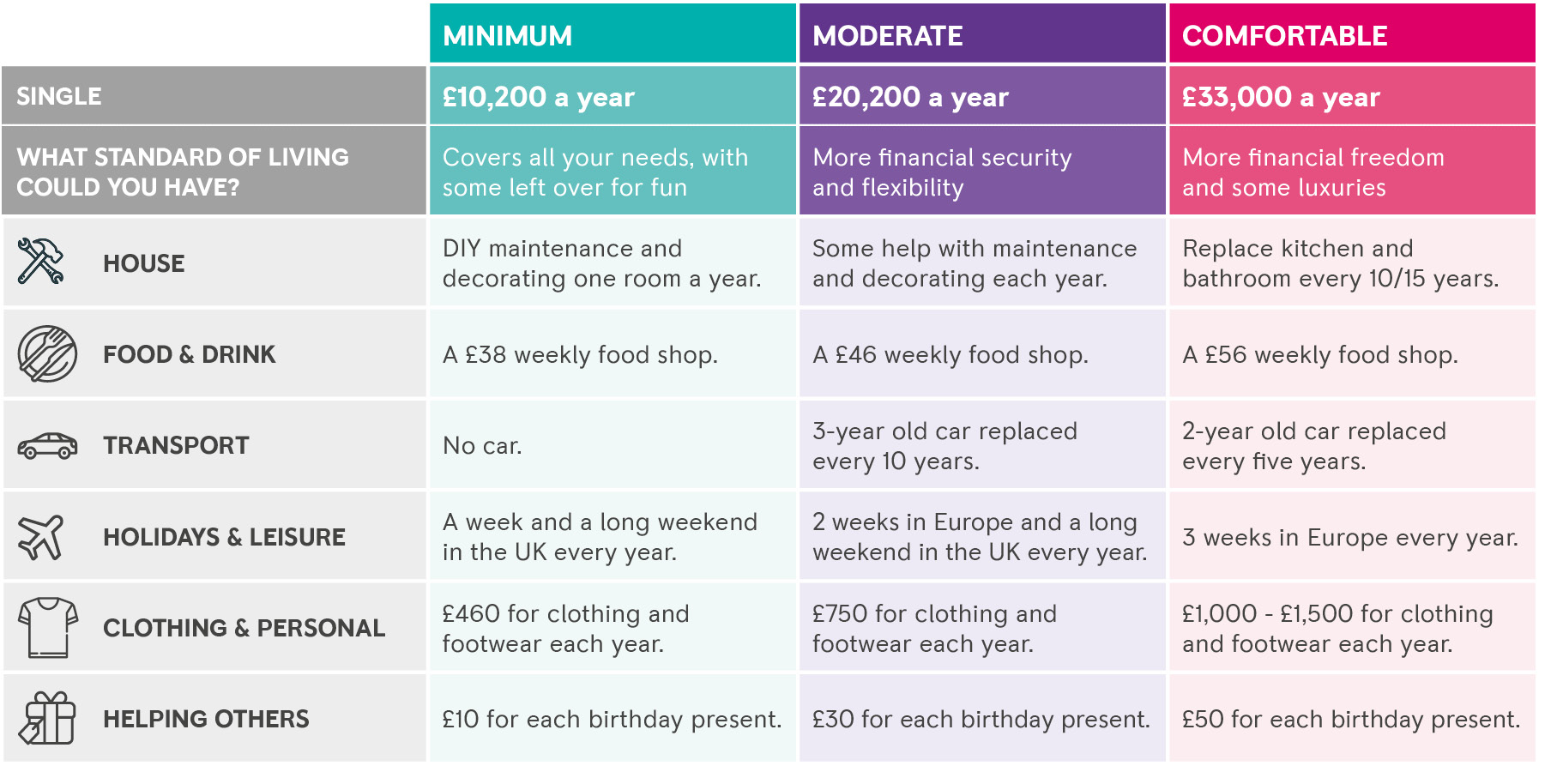

RETIREMENT LIVING STANDARDS

What does your retirement look like?

PLSA* RETIREMENT LIVING STANDARDS

- Independent research from Loughborough University

- To help you understand how much money you will need to live the lifestyle you want in retirement

- The Standards provide a benchmark level of annual income to different standards of living, based around the cost of a range of common goods and services. Different circumstances are taken into account.

- A 'minimum' lifestyle covers all your needs

- A 'moderate' lifestyle provides more financial security and flexibility

- A 'comfortable' lifestyle will allow you to be more spontaneous with your money

- Exploring categories could help picture what life in retirement could look like for each of the standards

NOMINATION FORM

Have you completed yours?

This form tells the Trustee who you want to receive the benefits that are payable when you die. These payments are made at the Trustee’s complete discretion, but your wishes will be taken into consideration when making a decision. It’s important that you nominate someone and make sure you update the details whenever your circumstances change.

You can update your Nomination Form online by accessing Aviva’s online services at either:

Aviva My Money: www.avivamymoney.co.uk/Login

My Aviva: www.direct.aviva.co.uk/MyAccount/login

LATEST NEWS

During January, around 7,200 new entrants were automatically enrolled into the Trust following the closure of the Rolls-Royce UK Pension Fund (RRUKPF), the Company’s defined benefit arrangement, on 31 December 2020. Overall, the onboarding process was handled smoothly and supported by a series of ‘bite-size’ communications and well-attended Aviva seminars. The closure of the RRUKPF to future accrual also resulted in the deferment of any AVC and Top-Up Section accounts to further contributions, although the opportunity to pay AVCs and/or merge accounts on an individual basis remains an option for active members in the future. Further details about the Trust can be found on the Rolls-Royce member website. Head to www.rolls-roycepensions.com and click on ‘I’m a Money Purchase member’ for details.

WHO ARE YOUR TRUSTEE DIRECTORS?

The Trust is managed by a corporate Trustee company, called Rolls-Royce Retirement Savings Trust Limited, whose Board of Trustee Directors is assisted by a group of professional advisers.

The Trustee Directors monitor and review the performance of Aviva’s administration function and the team is also audited externally by Deloitte LLP, as part of its annual audit.

The Trustee Board is now made up of five Company-Appointed Trustee Directors, which includes both a Chair and a Director nominated by the Central Negotiating Committee (CNC), as well as three Member-Nominated Trustee Directors elected through the support of members.

The Trustee runs the Trust in the interests of all its members and has responsibility for its governance and administration. During the year, Ian Farnsworth resigned as Chair following the end of his four-year term of office, Fiona Brown became a permanent member of the Trustee Board, and Nick Halliday was appointed as a new Member-Nominated Trustee Director.

More recently, Kevin Wright has been appointed as a Member-Nominated Trustee Director on account of the vacancy created by Mark Porter’s appointment as the new Chair.

Company-Appointed Trustee Directors

Mark Porter (Chair) – Works Convenor / Chair of UK Council, Rolls-Royce plc, Barnoldswick

Fiona Brown – Group Head of Pensions, Rolls-Royce plc, Derby

Rebecca Hodgson – Senior People Partner, Rolls-Royce plc, Derby

Teresa Waine – Internal Audit Manager, Rolls-Royce plc, Derby

CNC Trustee – to be confirmed

Member-Nominated Trustee Directors

Nick Halliday – Manufacturing Engineer, Rolls-Royce plc, Annesley

Matthew Hill – Chief of Strategic Patents, Rolls-Royce plc, Derby

Kevin Wright – General Machinist, Rolls-Royce plc, Inchinnan

Professionals engaged by the Trust

Pensions Adviser – Pensions Department, Rolls-Royce plc, Derby

Administrator – Aviva

Auditors – Deloitte LLP

Investment Consultant – Mercer

Investment Manager – Aviva

Legal Adviser – Gowling WLG (UK) Ltd

Life Assurance Providers – Aviva and Met Life

Secretary to the Trustee – Richard Hill, Pensions Specialist, Rolls-Royce plc, Derby

The Trustee Directors usually meet annually five times a year, with four quarterly meetings and a strategy event held during October. At the present time, meetings are being held on a virtual basis due to the pandemic, but it is hoped face-to-face meetings will recommence as soon as it is safe to do so in line with government guidelines and Company policy. Each Trustee Director typically serves a four-year term, with a maximum of two terms before rotating off the Board.

ARE YOU GETTING VALUE FROM THE TRUST?

Each year, the Trustee Board must produce a Chair’s Statement that summarises the Trust’s arrangements and explains to members how it provides value for money.

In summary, this year’s Chair’s Statement:

- Describes the robust governance around the Trust’s investment fund options and our thinking behind the structure of the default investment options, the overall fund range and a summary of the recent investment changes.

- Describes how the Trustee monitors and reviews the Trust’s administration services and ensures that core financial transactions are processed efficiently.

- Confirms the charges and transaction costs for the range of funds available for you to choose from, including the Annual Management Charge (AMC) and an illustrative example of the cumulative effect over time of these charges on your retirement income.

- Confirms the Trustee’s view that the Trust continues to provide good value – both in those areas where you meet some or all of the costs (through the AMC) and also where the related costs are met solely by Rolls-Royce, e.g. governance.

- Confirms the process by which the Trustee Directors maintain appropriate levels of knowledge and understanding and how they review their effectiveness.

The latest full Chair’s Statement is available to view within the Trustee’s formal Annual Report and Financial Transactions, which are published on a separate Aviva website for your information: https://vfm.aviva.co.uk/rolls-royce/

ADVICE ON OFFER

If you’re an active member who is leaving the Company and aged 55 or over, you’re entitled to personal retirement advice by WPS Advisory, funded by the Company.

YEA OR NAY?

Let us know what you think about this online report. Send your feedback to

[email protected]"Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed quia consequuntur magni dolores eos qui ratione voluptatem sequi nesciunt. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem. Ut enim ad minima veniam, quis nostrum exercitationem ullam corporis suscipit laboriosam, nisi ut aliquid ex ea commodi consequatur? Quis autem vel eum iure reprehenderit qui in ea voluptate velit esse quam nihil molestiae consequatur, vel illum qui dolorem eum fugiat quo voluptas nulla pariatur?"

MYAVIVA – THE EASY WAY TO ACCESS YOUR RETIREMENT SAVINGS

The best way to keep up to date with your retirement savings account is to register for Aviva’s online services, which you now can access on the go or at home using the MyAviva website or app. And if you have more than one account in the RRRST, you can see them all in one place using a single login.

MyAviva gives you access to your Trust account and other useful tools from a phone or tablet.

MyAviva is available on your desktop at www.direct.aviva.co.uk/MyAccount/login and as an app, which gives you the convenience of easy access wherever you are (mobile data charges may apply). Just search for MyAviva in your phone or tablet’s app store.

MyAviva gives you quick and easy access to your retirement savings, so that you can:

- Find out your current fund value at any time

- Get into the habit of regularly checking how your retirement savings are doing

- Use the online tools to see if you’re on the right track for the retirement you want

- Switch investment funds or amend your nominated beneficiaries

The best way to register for MyAviva is to simply visit www.aviva.co.uk/worksite-myaviva and make sure you have your membership number with you. But you can still register if you don’t know your membership number at the same link.

Members who have already registered for Aviva’s My Money website can continue to use this service with their existing login. You can access it at www.avivamymoney.co.uk/Login

Any problems logging in?

If you have any problems, you can contact Aviva on 0345 604 9915. Lines are open Monday to Friday 8.30am – 5.30pm. Calls may be recorded and/or monitored.

Other information

You can find out more about the Trust on the Aviva RRRST microsite and the Money Purchase Section of the Rolls-Royce Pension Member website.

MAKING YOUR CONTRIBUTIONS COUNT

Most active members can now take advantage of the full flexibility available on contributions.

If you’re an active member with three years of membership, you now have full flexibility over the ‘core’ employee contribution you pay into the Trust, with your employer paying double what you decide to pay (up to a cap of 12%).

A transitional period still applies for some members, particularly those who were hired after 1 May 2018 and are yet to complete three years’ service. Find out about the transitional arrangements in the Contribution Structure section of www.rolls-roycepensions.com/SavingsTrust. Please scroll across on the table below if using a mobile device.

Core design

|

|

You pay |

Company pays |

Total invesment |

|---|---|---|---|

| Minimum | 3% | 6% | 9% |

|

|

4% | 8% | 12% |

|

|

5% | 10% | 15% |

| Maximum | 6% | 12% | 18% |

Paying Additional Voluntary Contributions (AVCs)

It’s also possible to provide extra benefits at retirement by making additional contributions to the Trust, although these represent your own voluntary contributions and are not matched by the Company.

Changing your ‘core’ contributions or paying AVCs

The Company’s TotalReward Portal is where you’ll need to go if you want to increase how much you pay into the Trust, either through a change in your ‘core’ contribution or AVCs. Just like your regular contributions, you’ll benefit from tax relief on these additional savings. Any change that you make on the portal will be actioned for the next available payroll run, providing the change is made before payroll cut-off.

To access the TotalReward Portal, visit www.rolls-royce.com/totalreward. To review or amend your contributions click on Benefits, then My Retirement.

INVESTMENTS

How you invest your account can make a big difference to its value at retirement. There are two ways you can invest your money in the Trust – ‘hands-off’ or ‘hands-on’, as explained in this article.

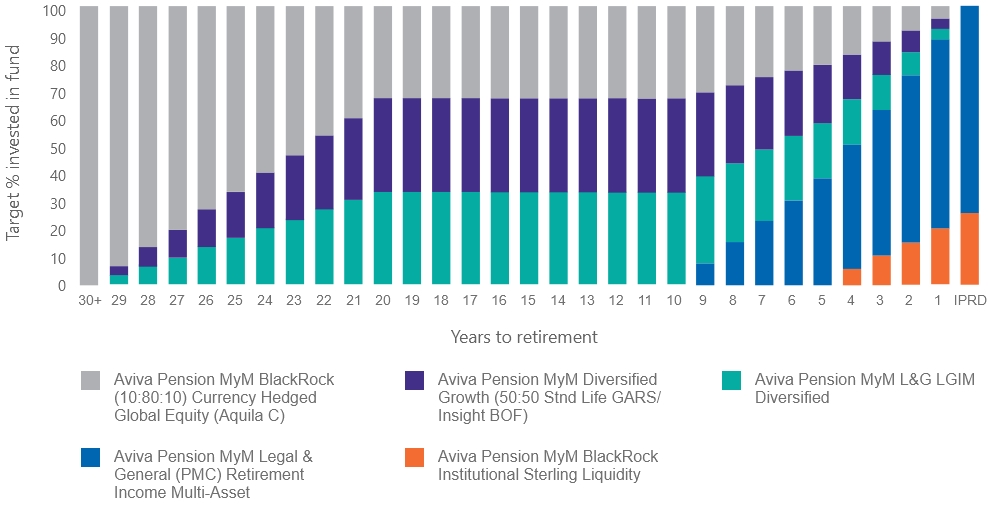

‘Hands-off’ approach: automatic investment programmes

Most members of the Trust currently have their contributions invested with Aviva through the default investment programmes, which work by automatically moving the money in your account from investment funds with the potential for growth into lower-risk investments, that better match your plans, as you approach retirement.

The Trustee has made three ready-made investment programmes available, which are specifically designed to do everything for you and to meet the different ways in which you can access your retirement savings:

Cash – assumes that you’ll take your entire account as cash at retirement

Drawdown – assumes that you’ll take cash from your account flexibly using income drawdown

Annuity – assumes that you’ll use your account to buy an annuity at retirement

Drawdown investment programme – the default

The drawdown investment programme is the default arrangement for most members, including recent new joiners and those who joined automatically on account of the closure of the Rolls-Rolls UK Pension Fund. In other words, this is how your account is invested if you don’t make a decision one way or another.

'Hands-on' approach: self-select investment range

If you want to choose how your account is invested and you don’t want to invest in one of the three investment programmes, the Trustee has made a range of investment funds available. Unlike the investment programmes, your self-select investments won’t automatically move from higher to lower-risk investments as you approach your selected retirement age – you will have to manage this process yourself. The full range of funds can be found here and you can also download factsheets for each of the available funds and change your investments by visiting the Aviva website.

Expansion of the self-select investment range

In consultation with its investment adviser, the Trustee has recently agreed to expand the range of self-select funds available to members. The two new funds fill gaps within the Trust’s current asset classes, as follows:

- BlackRock Over 15 Year Gilt Index Fund

An index-linked fund offering longer-term gilts than what is currently available. The Annual Management Charge (AMC) is 0.16% p.a. The Aviva factsheet can be viewed here.

- LGIM Future World Fund

An equity fund specifically focusing on managing the risks and taking advantages of opportunities associated with climate change. The Annual Management Charge (AMC) is 0.44% p.a. The Aviva factsheet can be viewed here.

It is anticipated that the range of self-select funds will be subject to a wider review by the Trustee alongside the overall investment strategy next year.

YOUR OPTIONS AT RETIREMENT

Under current legislation, when you take your retirement savings you’ll be able to use the money that has built up in your account in a number of different ways.

Cash

You can take some or all of your account as cash.

Drawdown

You can invest your account with a drawdown provider and withdraw money whenever you like, with no restrictions on the amount you can draw down.

Annuity

You can use some or all of your account to buy an annuity at retirement.

You can also choose a combination of these options. Aviva will provide you with full details of your options when you come to retire.

Under each of the above options you can take up to 25 per cent of your account as tax-free cash, with the remainder being taxable at your marginal rate (for example 20 per cent, 40 per cent or 45 per cent).

To find out more about your options at retirement and how they work, the government runs Pension Wise – a free and impartial service from MoneyHelper, which aims to help Defined Contribution members who are over 50 understand their options as they approach retirement. Visit the website at www.moneyhelper.org.uk/en/pensions-and-retirement/pension-wise to book a free telephone or face-to-face appointment.

KEEP THE SCAMMERS AT BAY

The Pensions Regulator provides some tips on how to avoid a pension scam, which you can access here.

We have also provided information on the pension member website about financial advice and reported scams, to help you keep your pension safe.

Please take every precaution when transferring your benefits away from the Trust. To make sure you’re getting the right advice, please use the services provided by WPS Advisory, as they are recommended by both the Trustee and the Company.

The number of reported cases of pension fraud has more than doubled during the pandemic, as scammers capitalise on savers’ fears. Stay alert and protect your pension from scammers.

ON THE ROAD TO RESPONSIBLE INVESTMENT

The Trustee believes that well-run companies that take account of ESG (Environmental, Social, and Governance) factors will offer better returns to investors over the long term, so like many other pension schemes we are actively looking at ESG issues and how we can be a responsible investor.

The Trustee also recognises that long-term sustainability issues, particularly climate change, increasingly need to be considered as part of the investment decision-making process.

The Trustee has given our appointed investment managers full discretion in evaluating ESG factors, including climate change considerations, and exercising shareholder voting rights, in accordance with their own corporate governance policies and current best practice, including the UK Corporate Governance Code and UK Stewardship Code. Managers are also expected to be signatories to the United Nations-supported Principle for Responsible Investment (UNPRI) unless a suitable reason for not being is provided. As the Trust uses pooled investment funds, rather than investing directly in companies, the Trustee accepts that the assets are subject to the investment fund managers’ own policies in this area. Other key considerations are provided below:

- When appointing new managers and monitoring existing managers, the Trustee considers how ESG, climate change and stewardship is integrated within investment processes.

- The Trustee has set a target that all equity investment managers be highly rated by Mercer for ESG integration and active ownership, with a minimum rating of ESG3 or better, where possible. This is monitored and recorded at least annually.

- The Trustee does not take into account ethical views when choosing the funds available to members and in the investment strategies. However, the Trustee does offer a specific ethical fund in the self-select fund range.

- The Trustee will ask the investment managers to disclose climate-related risks as part of their portfolio reporting, within the framework of the Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD).

- The Trustee also periodically reviews the appropriateness of making individual ESG or sustainable investment choices available to members.

FACTS & FIGURES

We’ve pulled together a summary of the Trust’s latest report and financial statements, but you can see the full document here.

The Trust’s annual accounts are audited by Deloitte LLP, the independent auditor. The following information is taken from the Trust’s accounts for the year ended 5 April 2021.

Assets under management

Membership

Active*

27,760

Deferred

6,421

*Due to members with multiple accounts, the actual number of individual active members is 19,935 as at 5 April 2021.

OTHER INFORMATION

There is lots of information available online to help you understand your benefits in the Trust, including the Money Purchase landing page on the Rolls-Royce pension member website.

The Money Purchase landing page has a host of useful general information on the Trust, including interactive member and investment guides, as well as a link to the MyMoney website, which is still available alongside MyAviva.

The Money Purchase landing page can be accessed here: www.rolls-roycepensions.com/SavingsTrust

The Trust also has various online documents available for members, which you can access by registering for the Aviva online services. This includes a new combined member and investment guide which:

- Provides useful information on the benefits, including details of your life cover and your retirement options.

- Informs you more about your investment choices and explains the level of risk associated with each of your fund choices.

Formal documents

If you want to see any of the Trust’s formal documents, these are available on request.

Internal Dispute Resolution Procedure

The Trustee Directors have an Internal Dispute Resolution Procedure available to members. This procedure is in line with statutory requirements. In the event of a member wishing to make a complaint, the first point of contact for all disputes is to send it in writing to the Trustee Secretary:

The Secretary to the Trustee

Rolls-Royce Pensions (JH-19)

PO Box 31

Derby

DE24 8BJ

Keep in touch

Has Aviva got your correct contact details? And is your Nomination

Form up to date? It’s important to keep your details up to date so

that we can contact you about your benefits in the Trust.

Tel: 0345 604 0803

Email: [email protected]